Western home loan proprietors try upbeat that collateral in their property try rising, that’s enabling fuel- getting greatest or even worse – a massive upsurge in house equity lending, this has people that over 50 exploring its alternatives and you will beginning to contemplate guarantee release and you may if it is great to them. It is rather beneficial to have the products for the credit, in order to make certain you make correct choice, to your backing regarding professional advice.

Nearly 50 % of (46%) of all You. The same survey learned that of several customers don’t realize simply how much industry has retrieved, loanDepot said. Simply 57% thought their house’s worthy of rose after all in the past around three age, and you may a quarter of these class believes it rose lower than 5%. The way it is Shiller 20-town directory suggests prices rose twice this much, indeed, 10% of – even in the event house rate develops are intensely local, and never anyone in the us was enjoying double-fist expands.

Nevertheless, so much more domestic equity seems to be translating toward sharp increases within the house equity financing passion. Exactly how many the fresh HELOCs – house collateral lines of credit – originated age period 12 months in the past, and also at the greatest height because 2008, based on Equifax.

Meanwhile, the total balance regarding household security funds originated from try $21.9 billion, an effective 20.1% increase off same date this past year; and the final number of brand new home collateral funds to own subprime individuals (i.e. people no wait cash advance North Grosvenor Dale CT with poor credit scores) try 652,2 hundred, a rise away from 24.7% as well as the large level once the 2008.

Naturally, you will find a torn in the optimism anywhere between individuals who suffered the brand new downdraft of the 2008-09 housing recession, and those who ordered their homes afterwards, loanDepot told you.

New results is in keeping with a credit report the 2009 times sharing that the number of underwater homeowners – those who owe regarding their home loan than just their house try value – enjoys decrease sharply

- Far more buyers which purchased shortly after 2009 (64%) trust their house possess achieved well worth as 2013 as compared to 58% from pre-2009 customers.

- A whole lot more consumers which ordered after 2009 (50%) be prepared to acquire way more collateral this current year versus 43% out-of pre-2009 buyers.

- Far more pre-2009 residents (65%) trust he has got enough equity now to obtain a home collateral mortgage compared to the only more than 1 / 2 of (52%) out of blog post-2009 buyers.

Homeowners whom purchased during the housing increase is regaining security of numerous believe try shed forever, yet , unnecessary do not know the brand new guarantee they have attained or they are confused about ideas on how to determine changes in its equity, told you Bryan Sullivan, chief monetary manager from loanDepot, LLC.

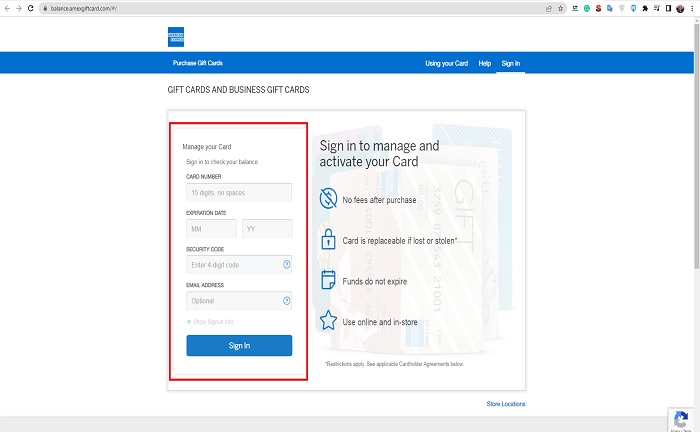

A number of on the internet gadgets render house worthy of estimates, and owners who had been bashful to seem recently usually takes a peek at particularly websites – however, remember they offer just crude estimates. The true value of property is only determined when a great real client shows up prepared to create a check. Addititionally there is a security discharge calculator that can help you figure out how much you’ll collateral you’ve got of your home.

However, banks or any other nonbank lenders believe new equity obtain story sufficient to release money to have domestic equity loans.

Property owners have a tendency to pick a HELOC to finance delinquent renovations. The newest Harvard Shared Cardio having Houses Education thinks an increase inside the do-it-yourself tactics is on its way. They tactics purchasing growth to possess home improvements will accelerate of cuatro.3% in the 1st quarter off 2016 in order to 7.6% in the 3rd one-fourth. (You can discover more about family security financing and HELOCS here.)

S. homeowners that have a mortgage assume the collateral increase within the 2016, having a quarter of those optimists expecting it to rise anywhere between 6% and you can ten%, according to another survey put-out by the nonbank financial loanDepot

A special popular fool around with to own a home equity mortgage should be to spend out of credit card debt. However you might be wary about this plan. Transitioning large-interest personal credit card debt to the reduced-appeal home guarantee loans are going to be appealing, and it may help some users get out of a large monetary hole. However it commonly fails to solve the root issue of also much paying rather than enough money. A get back to security cannot imply a come back to the sort regarding home-as-Atm free-using activities certain consumers accompanied last ten years.

0 comentário