Just last year, more 120,100 eligible individuals purchased homes using the reduced-prices USDA financing system. USDA lenders bring particular very large advantages and reasonable rates, faster financial insurance, with no down-payment criteria.

To be eligible for an excellent USDA mortgage, individuals need to fulfill specific money and borrowing requirements, together with possessions must be from inside the a beneficial USDA-designated urban area.

Qualifications with the USDA financing system retains you to particular income and you may borrowing from the bank criteria, and criteria to the domestic you get.

You will be eligible to play with an effective USDA financial in the event that:

- The house really stands within a great USDA-designated town

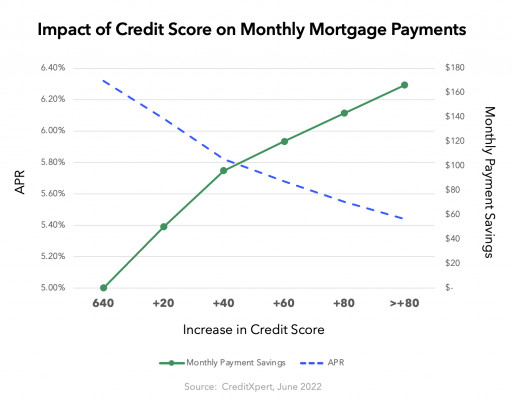

- You satisfy lowest financial credit requirements (640 is the normal cutoff, however it may differ by the financial)

- Your household’s total income drops within 115% of your own median earnings near you

- Your income try secure and consistent

- The property tend to act as most of your household

- You’re a good U.S. citizen, non-citizen federal, or licensed alien

Money Criteria having USDA Financing

Is eligible for a good USDA mortgage, needed a constant income source. Your lender tend to make certain it money with your earnings files (paystubs, W-2’s, lender statements) also verification from your boss.

Money Limits having USDA Loans

USDA funds give an affordable funding choice for lower-to-moderate-income homeowners. As a result of this, your household’s full earnings can’t exceed regional USDA income restrictions. Income limitations is calculated having fun with 115% of the area’s median household earnings.

The modern simple USDA loan income restrict for one-4 user houses try $103,five-hundred. For 5-8 affiliate houses, brand new maximum was $136,600. USDA loan limitations could be high so you’re able to account for places where property and you may earnings are a bit pricier.

Borrowing Standards getting USDA Loans

The new USDA doesn’t have a reliable standard into lowest credit ratings for debtor qualifications. Minimum credit requirements are ready because of the bank and can will vary. An average cutoff for the majority USDA lenders is actually 640. Although not, of numerous loan providers most definitely will work with you to establish your own creditworthiness in another way using compensating activities.

In the event your credit drops lower than 640 or you have not established borrowing from the bank record, you could find you might however get good USDA mortgage because of the talking with the best USDA financial.

Certain lenders will as an alternative explore compensating what to show your creditworthiness into the underwriting. Documenting a healthier bank account and holding almost no debt is also help. If the latest month-to-month property expense could well be lower than your own new house payment, that works well, too.

On the other hand, the financial may ask you to establish what is actually entitled a low-antique tradeline. This is done appearing 12 months away from on the-day costs to the power bills, lease, medical insurance superior, or other normal expenses. Demonstrating your own desire and you may power to take care of these types of monthly premiums strengthens your loan app to possess underwriting.

What properties are eligible?

Merely services in this USDA-designated outlying elements can be purchased with a USDA financial. The word rural doesn’t merely indicate farmland and you may belongings during the extremely secluded section. There are of numerous residential district services which might be qualified to receive USDA money too.

The condition of the house you may be buying matters, also. The newest USDA outlines specific minimal property conditions (MPR’s) so that the house you order was a safe and voice resource. Likewise, such MPR’s improve USDA very carefully vet the home with the loan be certain that.

USDA Lowest Property Conditions

USDA mortgage brokers – or any other regulators-backed mortgage applications – need that payday loan Pleasant Valley attributes satisfy certain first criteria just before they may be funded.

- Direct access so you can a path, road, otherwise garage

- Right tools, h2o, and you can sewage disposal

- Good structurally voice foundation

Simply unmarried-household members house can be purchased which have USDA funding. While doing so, the house or property need certainly to act as much of your house. Capital functions and you may 2nd belongings was ineligible.

USDA Qualified Components

House have to be located in an eligible rural town so you’re able to qualify to have a great USDA mortgage. According to the Homes Advice Council, 97% of U.S. homes qualifies just like the rural from the USDA’s vision, accounting for around 109 million anyone.

0 comentário