In a few products, you could potentially be eligible for an alternate home loan two or three years shortly after a foreclosure. However you may have to wait prolonged.

The majority of people who possess been through a foreclosure question in the event the they will certainly actually ever manage to buy a home once more. Credit bureaus can get statement foreclosure on the credit file to have eight age following basic missed payment you to lead to the fresh foreclosures, extended when you’re trying that loan getting $150,000 or even more.

However, both, it might take lower than seven ages discover a separate mortgage once a foreclosure. Enough time you have got to hold off prior to getting a great the fresh new mortgage loan depends on the type of loan plus economic points.

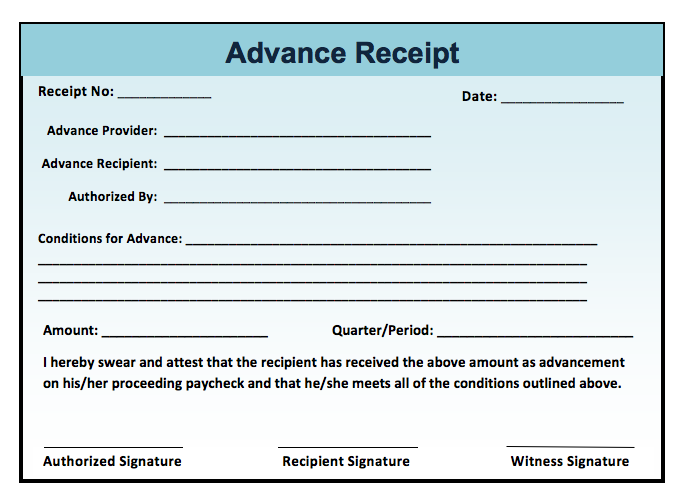

The fresh new graph less than suggests just how long brand new waiting period is once a foreclosure for several types of financing, with information less than.

And additionally, a foreclosures may cause a critical lowering of the credit ratings, it is therefore much harder locate an alternate home loan. Exactly how much your own scores tend to slide hinges on the effectiveness of your own borrowing prior to losing your house. If you had sophisticated credit ahead of a foreclosure, that is rare, your scores will go off more than if you’d currently got later otherwise missed costs, charged-from accounts, or other negative contents of your credit history.

If you can get financing, even with the new prepared months expires, depends on how good you’ve reconstructed their borrowing pursuing the property foreclosure.

Wishing Several months for Federal national mortgage association and you will Freddie Mac Finance Shortly after Foreclosures

Certain mortgages comply with guidance that the Government Federal Home loan Connection ( Fannie mae ) and Government Mortgage Financial Firm ( Freddie Mac ) place. Such fund, named “old-fashioned, conforming” financing, meet the criteria to be sold to help you Federal national mortgage association otherwise Freddie Mac computer.

Just before , the brand new waiting several months to own another type of loan following a foreclosure is five years. Today, to help you qualify for a loan lower than Fannie mae or Freddie Mac advice, you need to constantly hold off at the least eight age just after a property foreclosure.

Three-Season Wishing Several months To possess Extenuating Situations

You happen to be able to reduce the new prepared months to 3 age, counted throughout the conclusion big date of one’s foreclosure action, to have a fannie mae or Freddie Mac mortgage in the event the extenuating items (which is, a situation that has been nonrecurring, outside of the handle and you can led to an unexpected, tall, and you may offered lack of income or a disastrous increase in economic obligations) caused the foreclosures.

- confirm that property foreclosure is actually caused by extenuating factors, instance divorce proceedings, disease, abrupt death of household money, or work losings

- for Fannie mae, has a max financing-to-really worth (LTV) ratio of your new financial from possibly ninety% and/or LTV ratio placed in Fannie Mae’s qualification matrix, whichever try better

- having Freddie Mac computer, features a max loan-to-really worth (LTV)/complete LTV (TLTV)/Home Security Line of credit TLTV (HTLTV) proportion of minimal of 90% and/or limitation LTV/TLTV/HTLTV proportion toward deal, and you will

- utilize the the latest mortgage to buy a primary residence. (You simply cannot use the mortgage to order a second house otherwise investment property.)

Waiting Months having FHA-Insured Fund Once Property foreclosure

To help you qualify for that loan the Federal Homes Administration (FHA) means, your normally have to wait at least 36 months just after a property foreclosure. The three-season time clock initiate ticking when the foreclosure circumstances is finished, always on the big date that the residence’s identity moved due to the fact good results of the fresh foreclosure.

In the event the property foreclosure also inside it an FHA-insured loans Bay Lake FL financing, the 3-year wishing several months initiate whenever FHA repaid the prior lender on the the allege. (For many who cure your home so you can a foreclosures nevertheless the foreclosure purchases speed doesn’t completely repay an enthusiastic FHA-covered loan, the lender can make a state they new FHA, and the FHA compensates the lender towards the loss.)

0 comentário